An auto accident that results in injury is stressful and confusing under the best of circumstances, but what happens when an at fault driver dies?

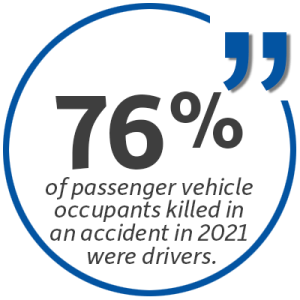

Tragically, this is not unheard of; in fact, 76% of passenger vehicle occupants killed in an accident in 2021 were drivers, according to the Insurance Institute for Highway Safety. While it’s not uncommon, that doesn’t mean that it’s not complicated.

In this article, we’ll explore your rights when the at fault driver passed away and how to best pursue compensation for your injuries.

What Are Your First Steps?

In any auto accident, the first thing you should do is call the police. If you’re injured too badly to make the call, ask a witness on the scene to do it. The police report will play a key part in your case, and it will prove that the other driver is responsible for the accident.

This report includes:

- Photos of the scene— These images show the damage to your car as well as any damage done to the area in general

- Surveillance footage—The police can also determine if any surveillance cameras in the area could provide video evidence

- Witness statements — Anyone who saw the crash, including the surviving passengers of either car, can give some insight into the accident.

Additionally, it’s important to get immediate medical attention. It’s possible that the nature of your injuries could help prove that the deceased driver was responsible for the accident, and it will provide much-needed information to determine what you might be entitled to financially.

Can You File a Claim Against a Deceased Driver?

In a word, yes. You might have some complicated feelings about pursuing compensation from a driver who passed away in the accident, but you shouldn’t be financially responsible for your injuries and for the damage done to your vehicle.

Bottom line: The deceased driver’s insurance is still in effect after their death. Indiana is not a no fault insurance state, so you can file an insurance claim against the driver’s insurance if that driver is found to be responsible for the accident.

No-fault insurance states, such as Florida, Kentucky, Michigan, and Minnesota, cover drivers regardless of who is at fault. In other words, your insurance would be responsible for your (and your passengers’) medical bills, even if you weren’t responsible for the accident.

What If They Don’t Have Insurance or Their Insurance Isn’t Enough?

If the driver was uninsured or underinsured, that doesn’t mean that your claim won’t be addressed. You could pursue payment from the deceased’s estate, and you might also need to file with your own insurance company if you had the foresight to buy uninsured motorist coverage.

Both of these options are time-consuming; probate can take months, if not years, and insurance companies are notorious for dragging their heels when it comes to compensation.

If you’re reluctant to face the at fault driver’s family in court, it’s best to work with an experienced car accident lawyer who’s well-acquainted with Indiana law.

What If There Were Other Deaths Due to the Accident?

If the accident was severe enough to result in the death of a passenger in your car, it’s possible that surviving family members could file a wrongful death lawsuit against the driver, even if the driver passed away.

According to Indiana law, not just anyone can file a wrongful death lawsuit. If the person who died was an adult, the person who is in charge of the estate can file the suit. If it was a child under 20, or under 23 and going to college/trade school, the child’s parents/guardians can pursue the lawsuit.

There’s also a strict timeline for a wrongful death lawsuit. Indiana law states that family members must file the suit within two years of the death. A car accident lawyer can help you determine the amount of damages you can legally seek in the state of Indiana.

What Comes Next? Talk to Crossen Law Firm

Car accidents are traumatic, particularly when they result in loss of life. Don’t try to go through this devastating event alone.

The experts at Crossen Law Firm have assisted many Hoosiers in navigating the challenges of getting the insurance settlements they deserve. If you or someone you love has experienced an auto collision, don’t hesitate to call 317-401-8626 for a free consultation or contact us online.

317-401-8626

317-401-8626

.jpg)