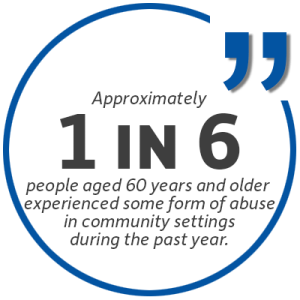

While nursing homes are necessary institutions for watching over senior citizens, various forms of abuse can occur in these establishments. Disturbingly, this includes physical abuse, neglect, emotional abuse, sexual abuse, and more. One form of abuse that’s often difficult to spot is elder financial abuse.

Financial abuse of elderly individuals can happen anywhere but is an especially serious problem in nursing homes. If you need to admit a parent, grandparent, or another loved one into a nursing home, you may not have the opportunity to see them as much as you’d like, and it’s likely harder for you to monitor their physical, emotional, and financial condition. This means they may be more vulnerable to unscrupulous individuals or institutions that could exploit their finances.

If you suspect that you or your loved one has been the victim of financial abuse or another form of mistreatment, consider contacting a nursing home abuse attorney to assist you.

What Is Financial Abuse?

Financial abuse occurs when someone exploits another person’s finances, property, or other assets for their personal benefit. The offender illegally takes the victim’s assets, or they may dupe the elderly individual into transferring them legally. The victim may not fully understand the ramifications of a transaction, or the deceivers may lie about the implications of the exchange.

Financial abuse isn’t strictly limited to taking advantage of elderly individuals, but it’s far more common for seniors to fall prey to scammers, con artists, or even immoral family members or caregivers. The reason why it’s far more common for the elderly to become victims of financial abuse is due to their deteriorating health. Older individuals often struggle with mental decline caused by Alzheimer’s disease, dementia, or a general cognitive degression, and this severely impacts their judgment.

The elderly may also have a great deal of trust in those who exploit them. Tragically, around 90% of perpetrators of financial fraud are family members, caregivers, or other individuals that the senior trusts. Some offenders even become close to seniors just to gain their trust and eventually dupe them out of money or assets.

Financial elder abuse often comes with incredibly serious consequences. The victim may no longer be able to afford basic necessities, such as housing and food. Unlike most Americans, these elderly individuals usually can’t work to rebuild their finances.

Examples of Elder Financial Abuse

While physical forms of abuse often have obvious signs, financial abuse can be harder to spot. For that reason, you need to be on the lookout for warning signs that your loved one is being taken advantage of.

Some common signs and examples of elder financial abuse in nursing homes include:

- Your loved one has a “new best friend”

- They have unusual transactions on their financial accounts

- They have a new debit or credit card

- The nursing institution or staff forges your loved one’s signature

- There’s missing money from your loved one’s account

- There’s an unexpected change in your loved one’s will

- They suffer from new depression or anxiety

- Some of their possessions are missing, especially valuables

- They transfer assets to a stranger, friend, or family member

- They have unpaid bills when they should have had enough money in their account

- They have new authorized users on a debit card or credit card

- Someone accompanies your loved one to their bank

- They have a new, unexpected power of attorney

- They say that they won a sweepstakes

- They discuss a new investment opportunity

- The nursing home overcharges them and lies about it

Reporting Elder Financial Abuse

If you suspect that your loved one was the victim of elder financial abuse, you need to report the incident or ongoing problem. You can start by contacting Adult Protective Services and the police. The number for Adult Protective Services in Indiana is 1-800-992-6978.

Additionally, you should report these occurrences of theft and financial abuse to the individual financial institutions involved. For instance, if someone exploits your loved one and steals from their bank account, you should report the incident directly to the financial establishment.

If you believe your loved one’s nursing home stole from them, you can contact your district’s nursing home ombudsman, a government official who investigates and helps resolve conflicts involving nursing homes.

Contact an Elder Abuse Attorney Today

Elder abuse is inexcusable, and if you suspect that your loved one has suffered from financial abuse or another form of mistreatment, you need to report it. You should also get in touch with a lawyer, as a seasoned elder abuse attorney can help prove your loved one was abused, and they can help your family recover just compensation.

Contact the experienced Indiana elder abuse attorneys at Crossen Law Firm. We’ve helped many families recover compensation for financial abuse, neglect, violence, and more. You can get a free consultation with us today by calling 317-401-8626, or schedule your visit online here.

317-401-8626

317-401-8626

.jpg)